This year’s General Meeting was an opportunity for SIDI to invite one of its partners to testify. Julio Flores, Managing Director of Financiera FDL, came to present the activities of this microfinance institution (MFI) which operates in Nicaragua, the 2nd poorest country in Central America.

The fruitful exchanges between Julio Flores and SIDI shareholders continued the following morning with a question and answer session. This time allowed us to go into more detail about FFDL’s business and its formidable resilience in the face of crises.

The NGO Fondo de Desarrollo Local (FDL) was created in 1993 by the Jesuits, following the civil war. FDL’s aim is to improve the living conditions of the most vulnerable Nicaraguans by providing them with loans, training and support services to help them develop their businesses, at a time when banks are not interested in this group. Financiera FDL has become the first MFI in the country and one of the largest in Central America. The institution mainly targets low-income people, farmers, breeders and micro-entrepreneurs in peri-urban areas. Thanks to its 38 branches, La Financiera has a strong territorial coverage, enabling it to provide 70% of its loans in rural areas, to populations with little access to credit.

Financiera FDL and its resilience to crises.

FDL’s growth was first slowed by the crisis between 2008 and 2011. In addition to the global economic crisis, an anti-MFI “Movimiento del no pago” (non-payment movement) has developed. It has led to a decline in the number of customers and payment defaults in the microfinance sector. FDL, despite a decline in portfolio and customers of around 50%, managed to restructure, before creating, alongside the NGO, the financial company Financiera FDL (FFDL) in 2016. To structure this financial company, FDL has chosen “international partners who share its vision”. As a result, SIDI became a minority shareholder.

A second crisis affected the country from 2018 to 2021. Politico-social conflict (murderous repression by the authoritarian regime) and economic instability led to a three-year contraction in GDP. Mass migration (10% of the population fled the country) was caused by persecution of civil society, including the Church. The number of FFDL customers has plummeted. This recession and drop in activity were exacerbated by the Covid crisis. Several MFIs have gone bankrupt, while FFDL’s portfolio has once again shrunk by 50% (more than $6 million in losses in 2018 and 2019)

FFDL overcame a number of challenges in order to emerge from the crisis: renewing its customer base, consolidating its portfolio and building up reserves. To support it, SIDI participated in the recapitalization of FFDL and made a 5-year subordinated loan (total outstanding amount of over €1.7 million in 2023). This second acquisition brings SIDI’s stake in FFDL to 4.4%. Backed by the support of its international shareholders, FFDL was able to negotiate with lenders to maintain its credit lines.

FFDL has achieved a spectacular turnaround. The portfolio has been growing since the end of the crisis, with a forecast +12% in 2024, which will enable us to recover the $6 million in losses recorded in recent years. All this has been made possible by the serious management and expertise of the company’s management team.

FFDL, an MFI with a strong social and environmental impact.

Nicaragua is one of the countries most exposed to climate change. The economy is partly based on cattle farming (54% of agricultural land), and the deforestation rate is the second highest in Central America. These activities are highly polluting and destructive, while severe droughts reduce agricultural yields by 20 to 40%.

Over the years, the MFI has developed a comprehensive range of support services for producers and breeders in the transition to agro-ecology. Support for producers in agro-ecological practices focuses on themes such as water management or arboriculture combined with animal husbandry. This technical assistance is paid for in part or in full by FFDL, depending on the customer’s standard of living.

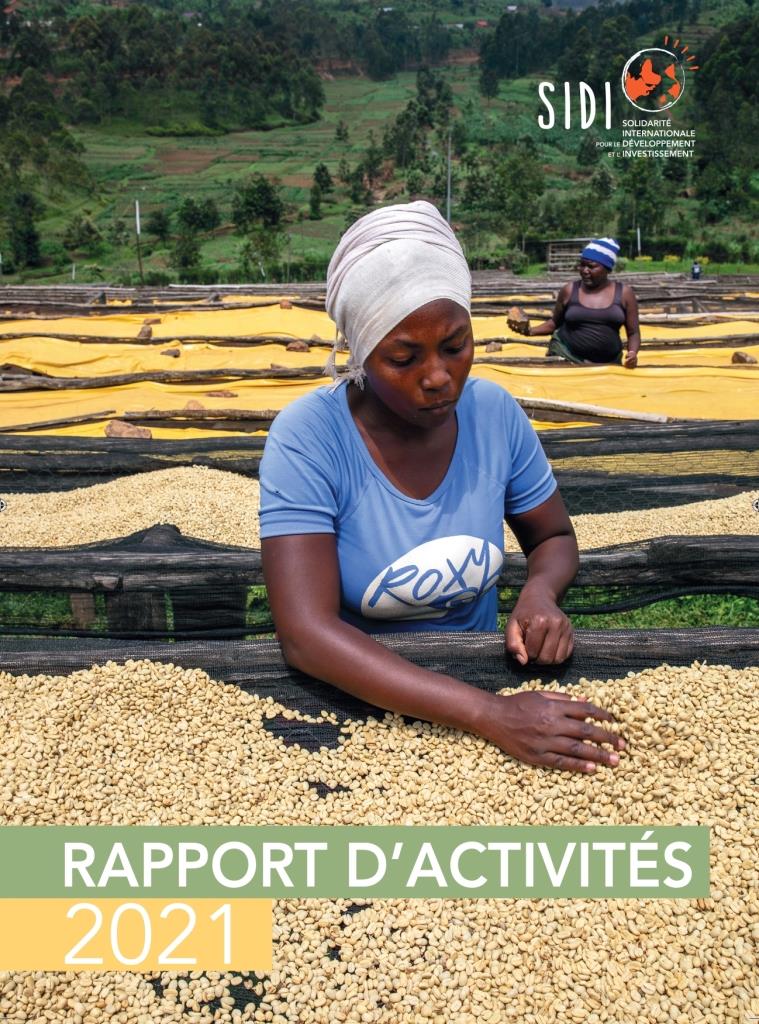

To improve producers’ incomes and reduce poverty, FFDL supports product processing, such as packaging coffee for export. This on-site processing of raw materials by producers creates added value, reduces the number of intermediaries and enables them to sell their produce at a higher price, guaranteeing local producers a better income.

FFDL seeks to maximize its impact, and the results are there. According to an independent survey partly financed by SIDI, in 2023, more than 60% of FFDL’s customers will report an improvement in their standard of living. The structure adapts its loan amounts and terms according to customers’ needs. It grants loans from 14 months on average (for traders and businesses) to 36 months for agricultural activities. This earned FFDL a Microfinance Index award in 2023. (see related article).

FFDL has demonstrated impressive resilience, while maintaining a strong social and environmental dimension, with a focus on financial inclusion in rural areas and environmental protection.

For Julio Flores, “although SIDI is a minority shareholder, it is very much involved in FFDL’s key moments. SIDI’s active participation in FFDL’s governance through the involvement of a volunteer consultant (on its Board of Directors) is decisive”.