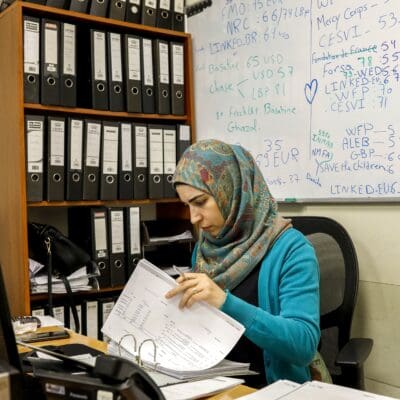

I took over the monitoring of the SIDI partnership for Lebanon in January 2025. A first mission, scheduled for February, had to be cancelled at the last minute due to the excessive Israeli bombardment of Beirut, despite the truce that had been signed. In May, I was finally able to leave, with my colleague Ariane Bevierre and a delegation from ADIE. During this mission, I discovered the resilience of Al Majmoua, the leading microfinance institution in Lebanon, a partner I know little about, but which is perfectly in line with SIDI’s target.

Banks in Lebanon are no longer operational

When I arrived, I discovered a country where there were no banking services and no financial activities. In 2020, following a massive devaluation, the banks confiscated savers’ assets ($90 billion!). The country’s elite got their money out in time. But the rest of the population found their accounts blocked and were unable to withdraw any money, except in small amounts. In recent months, it was still forbidden to withdraw more than 250 dollars a month. At this rate, it would take 3,000 years for Al Majmoua to recover the $9 million sequestered in his accounts. As a result, no one is depositing money with the banks, which are not granting any loans.

With average incomes plummeting and 30% of the population living below the poverty line, the demand for credit is enormous. The only recourse is money from the diaspora or microfinance. The problem? No donor wants to go to Lebanon any more because of the losses incurred during the crisis.

Lebanon’s financial crisis nearly wiped out our partner Al Majmoua

Before the crisis, Al Majmoua was a highly successful financial institution, managing over 100,000 loans. At the time of the crisis, it found itself on the verge of complete bankruptcy. With the devaluation of the Lebanese pound, its portfolio lost 99% of its value, given the exchange rate imposed. The association lost all its financial assets in the turmoil: $50 million!

The association’s bankruptcy was avoided thanks to the settlement of its debts by the donors, who assumed losses of $50 million, including $1 million for SIDI.

Loans repaid on time and on budget

After almost disappearing, Al Majmoua continues to operate with caution. With the little money it has, it issues modest loans averaging around $500. This enables it to reach more people. By April 2025, it had 23,000 loans outstanding. Of these, 85% are to support economic activity.

In Beirut, I visit a Palestinian chicken seller. The ceiling of her store collapsed during the Israeli bombardments. The loan will enable her to repair the ceiling, so that she can continue her business and gradually pay back her loan instalments.

Against the backdrop of Lebanon’s financial crisis and war, I’m impressed by Al Majmoua’s loan recovery rate of 98%. Including in bomb-ravaged southern Lebanon and the Bekaa plain.

Among the loan beneficiaries I met, I felt a strong sense of identification with Al Majmoua and recognition. For them, nothing is more important than paying, because Al Majmoua is the only entity that can lend them money for their projects. They hope that the association can continue to help them get back on their feet.

A global vision in the fight against poverty

I totally identify with Al Majmoua’s approach.

For Al Majmoua, microcredit is not an end in itself, but first and foremost a means of combating poverty. The association carries out both financial and non-financial activities. To support its members, it acts on various levers: financing, but also education and organization. For example, it offers a financial education program: how to manage a loan, a budget, a forecast. It’s a basic entrepreneurial culture that’s extremely important if you want to get out of poverty.

This posture is not so common in the world of microfinance. But it is totally in keeping with SIDI, which offers both financial services and support.

For me, this global approach is the most effective way to fight poverty. Because poverty has many facets, and credit alone solves nothing.

Supporting the rebirth of Al Majmoua

It’s not easy to think about lending again in Lebanon. SIDI (or rather FID, the guarantee fund backed by congregations, CCFD-Terre Solidaire and SIDI itself) has had to cover major losses. But this seems to me to be the right time to support Al Majmoua in its redeployment, at a time when so few organizations are backing it. It’s an institution that seems to me to have the potential and the qualities to turn itself around.

In a context where poverty has exploded, the demand for microcredit is very high. But so far, no one wants to return to Lebanon. Wouldn’t it make sense for SIDI, which “wants to go where others don’t go”, to get involved again?

It’s our job, as partnership managers, to maintain this balance between preserving the resources of SIDI’s shareholders and fulfilling the mission they entrust to us.

Interview by Anne-Isabelle Barthélémy

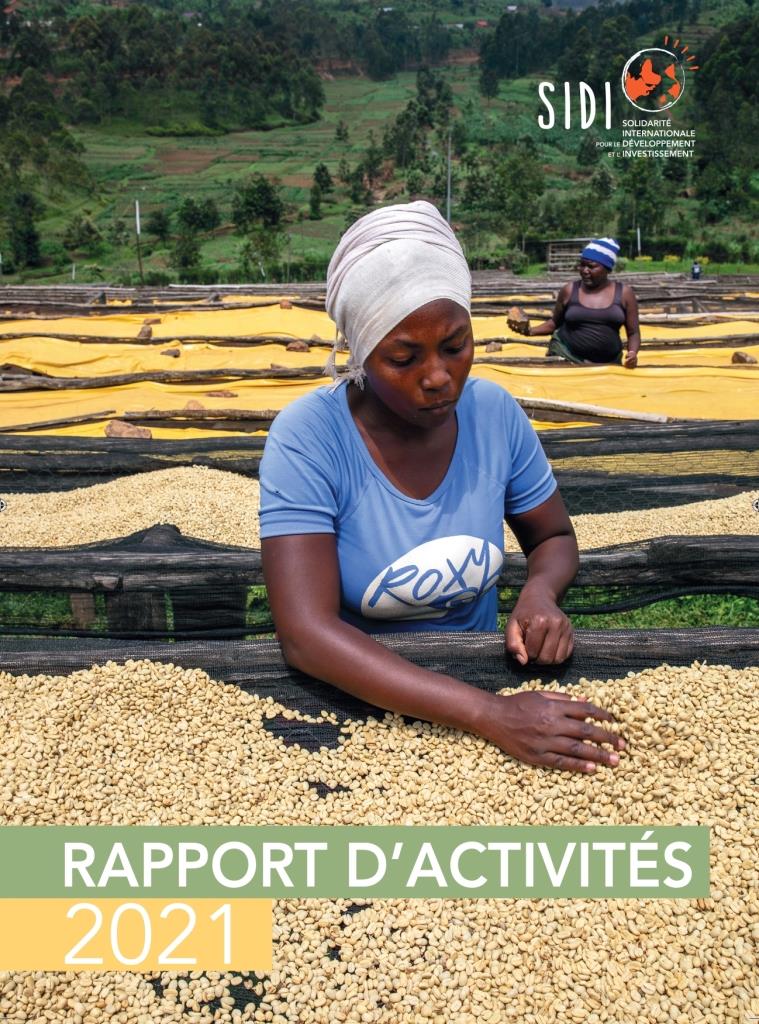

Photo credits: Philippe Lissac – agence Godong /SIDI; except ADIE cover photo